BVPS is significant for investors because it offers a snapshot of a company’s net asset value per share. By analyzing BVPS, investors can gain insights into a company’s financial health and intrinsic value, aiding in the assessment of whether a stock is over or undervalued. These articles have been prepared by 5paisa and is not for any type of circulation. 5paisa shall not be responsible for any unauthorized circulation, reproduction or distribution of this material or contents thereof to any unintended recipient. Kindly note that this page of blog/articles does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

What is a good PB ratio to buy?

Many businesses repurchase shares of their own stock using the money they make. Say, for example, that in the XYZ case the company buys back 200,000 shares of stock and there are still 800,000 outstanding. In addition to stock repurchases, a business may raise BVPS by increasing the asset balance and decreasing liabilities.

Companies Suited to Book Value Plays

The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated. The market value of a company is based on the current stock market price and how many shares are outstanding. Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. Book value per share relates to shareholders’ equity divided by the number of common shares.

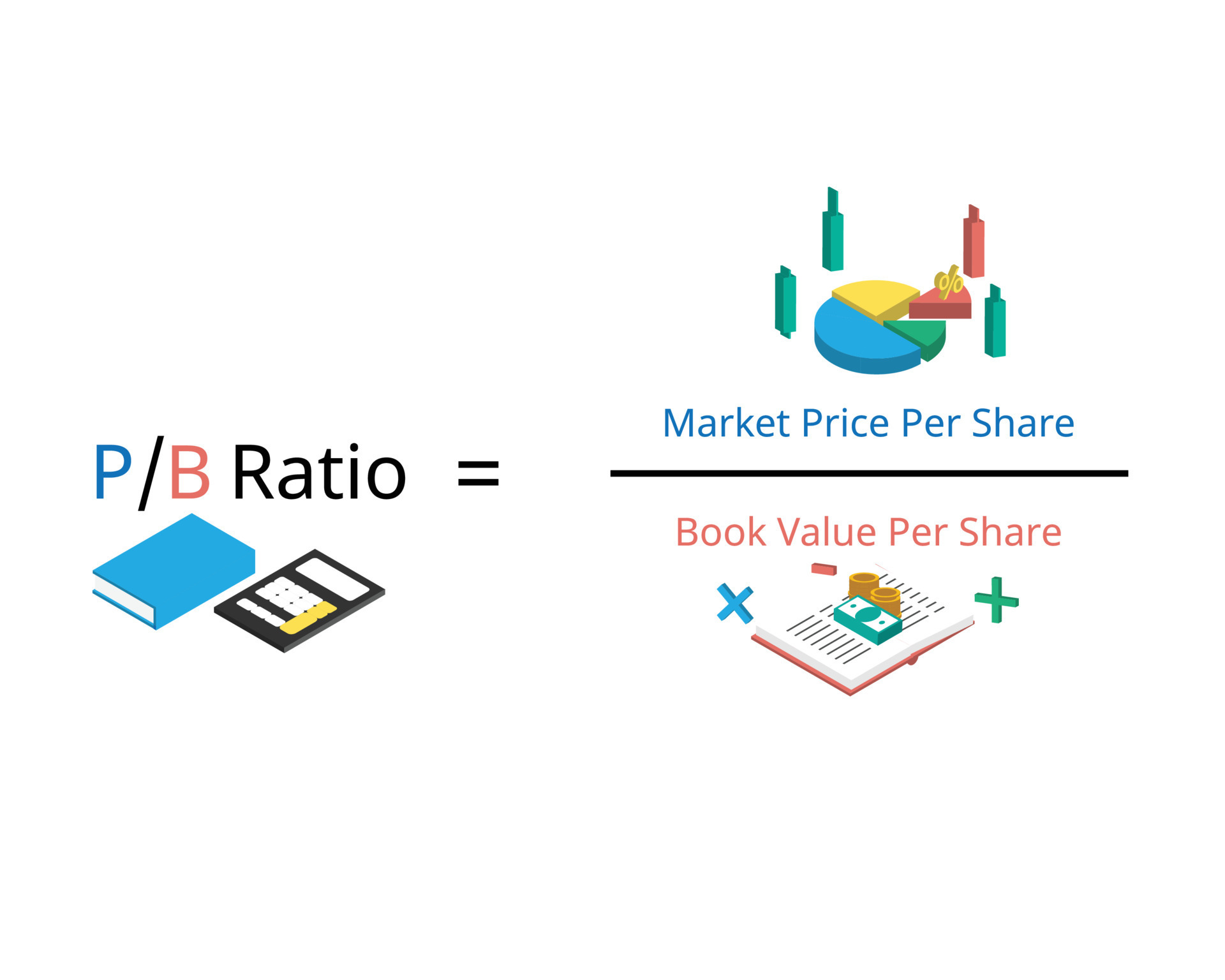

Price-To-Book Ratio

For any of these investments, the NAV is calculated by dividing the total value of all the fund’s securities by the total number of outstanding fund shares. Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool. Book Value Per Share is calculated by dividing the total common equity by the number of outstanding shares. However, the market value per share—a forward-looking metric—accounts for a company’s future earning power. As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Kindly note that, this article does not constitute an offer or solicitation for the purchase or sale of any financial instrument. In theory, a low price-to-book-value ratio means you have a cushion against poor performance. Outdated equipment may still add to book value, whereas appreciation in property may not be included. If you are going to invest based on book value, you have to find out the real state of those assets.

- The best strategy is to make book value one part of what you are looking for as you research each company.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders.

- Among these, the book value and the price-to-book ratio (P/B ratio) are staples for value investors.

- In theory, a low price-to-book-value ratio means you have a cushion against poor performance.

Book value is the amount found by totaling a company’s tangible assets (such as stocks, bonds, inventory, manufacturing equipment, real estate, and so forth) and subtracting its liabilities. In theory, book value should include everything down to the pencils and staples used by employees, but for simplicity’s sake, companies generally only include large assets that are easily quantified. If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors.

If a company’s BVPS is higher than its market value per share (the current stock price), the stock may be considered undervalued. This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. A part of a company’s profits may be used to purchase assets that raise both common equity and BVPS at the same time. Alternatively, it may utilize the money it takes to pay down debt, increasing both its common equity and its book value per share (BVPS). A second method to boost BVPS is by repurchasing common stock from existing owners, and many businesses utilize their profits to do so. Repurchasing common stock from existing owners is another method to boost BVPS.

Now, let’s say that the company invests in a new piece of equipment that costs $500,000. The book value per share would still be $1 even though the company’s assets have increased in value. Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding. In this case, each share of stock would be worth $0.50 if the company got liquidated. The difference between a company’s total assets and total liabilities is its net asset value, or the value remaining for equity shareholders. While BVPS considers the residual equity per-share for a company’s stock, net asset value, or NAV, is a per-share value calculated for a mutual fund or an exchange-traded fund, or ETF.

Book value per share is determined by dividing common shareholders’ equity by total number of outstanding shares. If quality assets have been depreciated faster than the drop in their true market value, you’ve found a hidden value that may help hold up the stock price in the future. If assets claim these “above are being depreciated slower than the drop in market value, then the book value will be above the true value, creating a value trap for investors who only glance at the P/B ratio. In the example from a moment ago, a company has $1,000,000 in equity and 1,000,000 shares outstanding.